Introduction

Planning for your financial future can feel overwhelming, but with the right tools and guidance, you can build wealth systematically. The Dave Ramsey Investment Calculator is a powerful tool that helps millions of Americans plan their investments and secure their financial future. Whether you’re just starting your investment journey or looking to optimize your existing portfolio, understanding how to use this Dave Ramsey Investment Calculator effectively can make a significant difference in your long-term wealth building.

Dave Ramsey, a renowned financial expert and best-selling author, has helped countless individuals achieve financial freedom through his proven principles. His investment calculator Dave Ramsey system is designed to simplify complex financial calculations and make investing accessible to everyone, regardless of their financial background.

Understanding Dave Ramsey’s Investment Philosophy

Before diving into the Dave Ramsey Investment Calculator itself, it’s essential to understand the foundation of Dave Ramsey’s investment approach. The Dave Ramsey investing calculator is built on several core principles that have guided millions toward financial success.

The Baby Steps Approach

Dave Ramsey’s famous Baby Steps provide a clear roadmap to financial freedom:

- Build a $1,000 emergency fund

- Pay off all debt except the house

- Build a full emergency fund (3-6 months of expenses)

- Invest 15% of household income for retirement

- Build college funding for children

- Pay off the home mortgage early

- Build wealth and give generously

The Dave Ramsey calculator investment tool becomes particularly relevant in steps 4 and beyond, where you’re ready to start building serious wealth.

Investment Strategy Fundamentals

Dave Ramsey Investment Calculator advocates for a simple yet effective investment strategy that focuses on:

- Growth stock mutual funds with long track records

- Diversification across different types of funds

- Long-term investing (10+ years minimum)

- Consistent contributions regardless of market conditions

- Dollar-cost averaging through regular investments

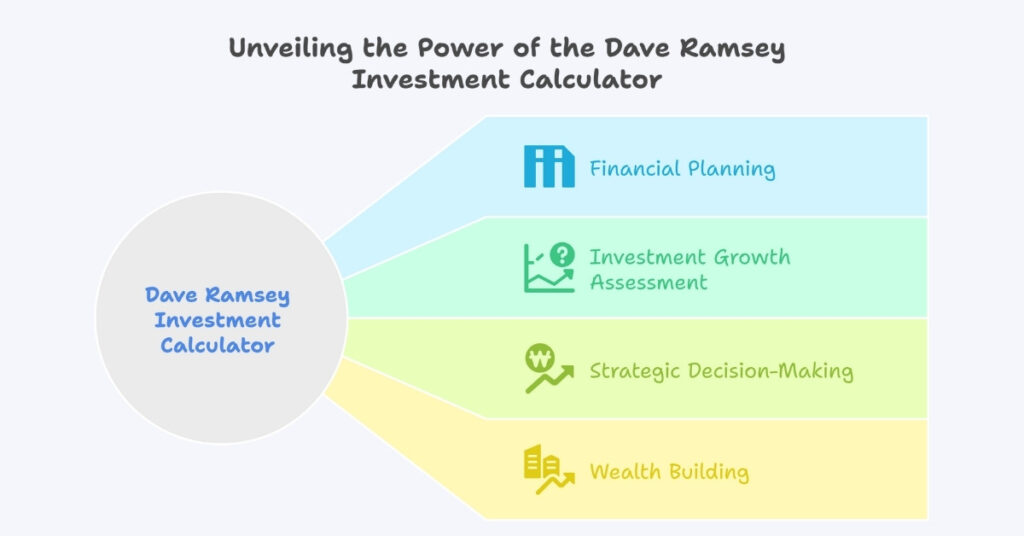

How the Dave Ramsey Investment Calculator Works

The Dave Ramsey investment calculator is designed to be user-friendly while providing accurate projections for your investment future. Understanding how Dave Ramsey Investment Calculator works will help you make informed decisions about your financial planning.

Key Components of the Calculator

The Dave Ramsey Investment Calculator typically includes several important variables:

Monthly Investment Amount: This is the amount you plan to invest each month. Dave Ramsey recommends starting with at least 15% of your household income once you’ve completed the first three baby steps.

Expected Annual Return: The Dave Ramsey Investment Calculator often uses a 12% average annual return, which is based on the historical performance of the S&P 500 over the past 80+ years. While this number may seem optimistic, it reflects long-term market performance.

Time Horizon: The number of years you plan to invest before needing the money. For retirement planning, this is typically your current age subtracted from your planned retirement age.

Initial Investment: Any lump sum you’re starting with, though many people begin with zero and focus on consistent monthly contributions.

Understanding the 12% Return Assumption

When using the Dave Ramsey’s investment calculator, you’ll notice it often defaults to a 12% annual return. This figure is based on:

- Historical S&P 500 performance since 1926

- Long-term averaging that smooths out market volatility

- The power of staying invested through market ups and downs

It’s important to understand that this is an average over decades, not a guarantee for any single year.

Types of Dave Ramsey Investment Calculators

Dave Ramsey offers several specialized calculators to meet different financial planning needs. Each serves a specific purpose in your wealth-building journey.

Retirement Investment Calculator

The retirement investment calculator Dave Ramsey style focuses on helping you determine how much you need to save for retirement. This Dave Ramsey Investment Calculator considers:

- Your current age and planned retirement age

- Desired retirement income

- Expected inflation rates

- Social Security benefits (though Dave often recommends not counting on them)

401(k) Investment Calculator

The Dave Ramsey retirement investing calculator and Dave Ramsey 401k investment calculator help you maximize your employer-sponsored retirement benefits. These tools factor in:

- Employer matching contributions

- Tax advantages of traditional vs. Roth contributions

- Contribution limits and catch-up contributions for those over 50

- Vesting schedules for employer contributions

College Investment Calculator

The Dave Ramsey college investment calculator helps parents plan for their children’s education expenses. This specialized tool considers:

- Rising education costs

- Different savings vehicle options (529 plans, ESAs, etc.)

- Time horizon until your child starts college

- Potential financial aid impacts

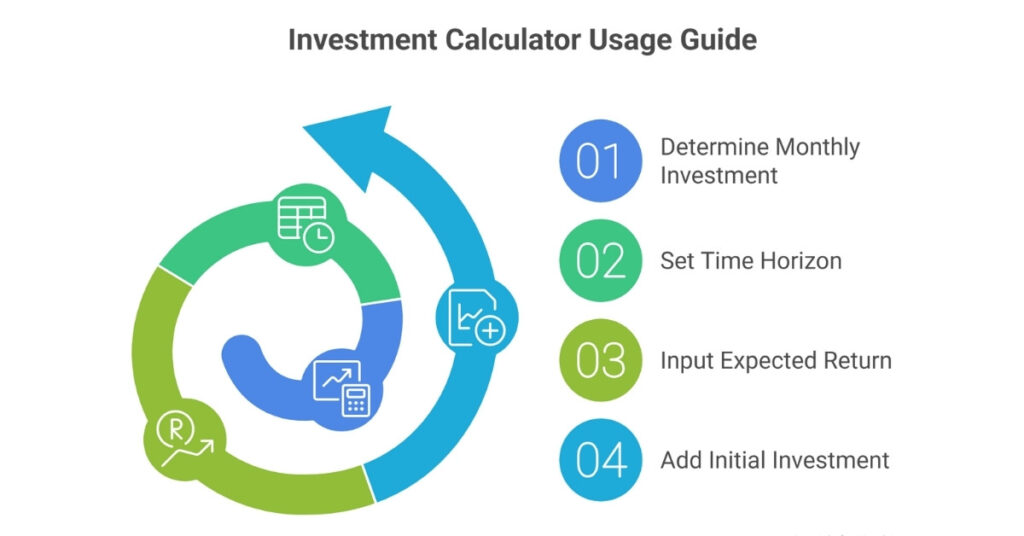

Step-by-Step Guide to Using the Investment Calculator

Using the Dave Ramsey Investment Calculator effectively requires understanding each input and how it affects your results. Here’s a comprehensive guide to get the most accurate projections.

Step 1: Determine Your Monthly Investment Amount

Start by calculating 15% of your household income. For example:

- Household income: $60,000

- 15% for investing: $9,000 per year

- Monthly investment: $750

Step 2: Set Your Time Horizon

Be realistic about when you’ll need the money. For retirement planning:

- Current age: 30

- Retirement age: 65

- Time horizon: 35 years

Step 3: Input Your Expected Return

While the Dave Ramsey Investment Calculator may default to 12%, consider your risk tolerance and investment mix. Conservative investors might use 10%, while aggressive investors comfortable with higher risk might use 12% or more.

Step 4: Add Any Initial Investment

If you have savings to start with, include this amount. Even $1,000 can make a significant difference over time due to compound interest.

Investment Calculator Comparison Table

| Calculator Type | Primary Use | Key Features | Best For |

|---|---|---|---|

| Dave Ramsey retirement investment calculator | Retirement planning | Long-term projections, compound interest focus | Workers 20+ years from retirement |

| Dave Ramsey 401k investment calculator | Employer plan optimization | Matching calculations, tax benefits | Employees with 401(k) access |

| Dave Ramsey investment and retirement calculator | Comprehensive planning | Multiple account types, goal setting | Complete financial planning |

| Dave Ramsey college investment calculator | Education funding | Rising cost projections, tax-advantaged accounts | Parents planning for children’s education |

Understanding Your Investment Calculator Results

When you use the investment calculator Dave Ramsey system, interpreting the results correctly is crucial for making informed financial decisions.

Reading the Projections

Your results will typically show:

- Total contributions: The amount you’ll invest over time

- Growth: How much your investments will earn

- Final balance: Your total account value at the end

- Monthly income potential: How much you could withdraw in retirement

The Power of Compound Interest

The Dave Ramsey investment growth calculator demonstrates compound interest beautifully. Here’s how $500 monthly grows over time at 12% annual return:

- 10 years: $115,000 (contributions: $60,000, growth: $55,000)

- 20 years: $493,000 (contributions: $120,000, growth: $373,000)

- 30 years: $1,335,000 (contributions: $180,000, growth: $1,155,000)

Adjusting for Reality

While the Dave Ramsey Investment Calculator provides excellent projections, remember to:

- Consider inflation’s impact on purchasing power

- Account for potential changes in income

- Plan for unexpected expenses or opportunities

- Review and adjust your strategy regularly

Investment Growth Scenarios Table

| Years Invested | Monthly Investment | Expected Return | Total Contributions | Projected Growth | Final Balance |

|---|---|---|---|---|---|

| 10 | $500 | 12% | $60,000 | $55,000 | $115,000 |

| 20 | $500 | 12% | $120,000 | $373,000 | $493,000 |

| 30 | $500 | 12% | $180,000 | $1,155,000 | $1,335,000 |

| 40 | $500 | 12% | $240,000 | $2,720,000 | $2,960,000 |

|| Also try this tool Snow Day Calculator

Common Mistakes When Using Investment Calculators

Even with the best tools like the Dave Ramsey investment return calculator, investors often make mistakes that can impact their financial future.

Mistake 1: Unrealistic Return Expectations

While how does Dave Ramsey calculate a 12% investment growth rate is based on historical data, some people expect this return every year. Markets fluctuate, and understanding this volatility is crucial for long-term success.

Mistake 2: Inconsistent Contributions

The Dave Ramsey Investment Calculator assumes regular monthly contributions. Missing payments or reducing contributions significantly impacts your results. Consistency is key to building wealth over time.

Mistake 3: Not Accounting for Inflation

Future dollars won’t have the same purchasing power as today’s dollars. When using the investment growth calculator Dave Ramsey style, consider that $1 million in 30 years might feel like $400,000 today.

Mistake 4: Ignoring Tax Implications

Different investment accounts have different tax treatments. The Dave Ramsey investment account calculator should factor in whether you’re using traditional or Roth accounts, as this affects your actual spending power in retirement.

Advanced Features and Considerations

The Dave Ramsey online investment calculator and related tools offer several advanced features that can help you fine-tune your investment strategy.

Roth vs. Traditional Calculations

When using the invest calculator roth ira Dave Ramsey approach, consider:

- Current tax bracket vs. expected retirement tax bracket

- Tax-free growth potential of Roth accounts

- Required minimum distributions in traditional accounts

- Flexibility for early retirement or large expenses

Emergency Fund Integration

Before using any Dave Ramsey Investment Calculator, ensure you have your emergency fund in place. The Dave Ramsey investment calculation methodology assumes you won’t need to withdraw from investments for emergencies.

Multiple Goal Planning

The investment planning calculator Dave Ramsey system can help you balance multiple financial goals:

- Retirement savings

- Children’s education

- House down payment

- Dream vacation or major purchases

Maximizing Your Investment Calculator Results

To get the most from the Dave Ramsey investment calculators, follow these proven strategies that align with his wealth-building philosophy.

Start Early and Stay Consistent

Time is your greatest asset when building wealth. Even small amounts invested consistently can grow into substantial sums. The Dave Ramsey free investment calculator shows how starting in your 20s vs. 30s can mean hundreds of thousands of dollars difference.

|| Also read VIPTools: Safe TikTok Growth Strategy

Increase Contributions Over Time

As your income grows, increase your investment contributions. The return on investment calculator Dave Ramsey approach suggests increasing contributions by at least the amount of any raise you receive.

Diversify Appropriately

Dave Ramsey typically recommends spreading investments across:

- 25% Growth and Income funds

- 25% Growth funds

- 25% International funds

- 25% Aggressive Growth funds

Review and Adjust Regularly

Your financial situation changes over time. Review your Dave Ramsey investment interest calculator results annually and adjust for:

- Income changes

- Life events (marriage, children, divorce)

- Market conditions

- Goal modifications

Technology and Tools Integration

Modern investment planning goes beyond basic calculators. The Dave Ramsey.com investing calculator and related digital tools offer enhanced features for today’s investors.

Excel Integration

Many investors prefer using the Dave Ramsey investment calculator for Excel or investment calculator Dave Ramsey Excel versions for more detailed analysis. These spreadsheets allow for:

- Custom scenarios and what-if analysis

- Detailed year-by-year projections

- Integration with other financial planning tools

- Backup and version control

Mobile Accessibility

The Dave Ramsey invest ment calculator (note: common misspelling) and Dave Ramsey investement calculator (another common misspelling) are often searched for mobile-friendly versions that allow you to:

- Check projections on the go

- Adjust contributions based on budget changes

- Share results with family members

- Track progress toward goals

ELP Integration

Dave Ramsey’s Endorsed Local Providers (ELP) program connects you with investment professionals who follow his principles. The Dave Ramsey ELP investing calculator approach combines:

- Professional guidance

- Standardized calculation methods

- Local market knowledge

- Ongoing support and advice

Real-World Application Examples

Understanding how to apply the investing Dave Ramsey calculator principles in real-world scenarios helps make the concepts more practical and actionable.

Example 1: Young Professional Starting Out

Sarah, age 25, earns $45,000 annually and wants to retire at 65:

- Monthly investment: $562.50 (15% of income)

- Time horizon: 40 years

- Expected return: 12%

- Result: Approximately $2.2 million at retirement

Example 2: Mid-Career Catch-Up

Mike, age 40, earns $80,000 and just completed Baby Step 3:

- Monthly investment: $1,000 (15% of income)

- Time horizon: 25 years

- Expected return: 12%

- Result: Approximately $1.9 million at retirement

Example 3: Late Starter Maximizing Contributions

Linda, age 50, earns $100,000 and wants to retire at 67:

- Monthly investment: $1,250 (15% of income)

- Catch-up contributions: Additional $500/month

- Time horizon: 17 years

- Expected return: 12%

- Result: Approximately $1.1 million at retirement

Troubleshooting Common Calculator Issues

When using the Dave Ramsey.investment calculator or Dave Ramseys investment calculator, you might encounter some common issues or have questions about the results.

Results Seem Too Good to Be True

If your projections seem unrealistic, consider:

- Are you using the correct time horizon?

- Is your expected return rate reasonable?

- Have you factored in inflation?

- Are you being realistic about consistent contributions?

Calculator Not Loading or Functioning

Technical issues with the ramsey dave investment calculator might be resolved by:

- Clearing your browser cache

- Checking your internet connection

- Trying a different browser or device

- Visiting the official Dave Ramsey website directly

Comparing Different Calculator Results

Different versions of the investment calculator by Dave Ramsey might show slightly different results due to:

- Rounding differences

- Different compound frequency assumptions

- Varying fee calculations

- Updated return assumptions

External Resources and Authority Links

To enhance your investment knowledge and verify the principles used in the 401k investment calculator Dave Ramsey system, consider these authoritative sources:

- Securities and Exchange Commission (SEC) – Investor.gov provides unbiased information about investment fundamentals and regulations

- Federal Reserve Economic Data (FRED) – Historical market data and economic indicators

- Social Security Administration – Official retirement planning resources and benefit Dave Ramsey Investment Calculator

- Internal Revenue Service (IRS) – Tax implications of different investment accounts and strategies

- Financial Industry Regulatory Authority (FINRA) – Investment education and broker verification tools

FAQs: People Also Ask

What is the Dave Ramsey investment calculator?

The Dave Ramsey investment calculator is a financial planning tool that helps you project investment growth based on regular contributions, expected returns, and time horizon. It’s designed to show how consistent investing can build wealth over time.

How accurate is the 12% return assumption?

The 12% return is based on historical S&P 500 performance over 80+ years. While it’s a reasonable long-term average, actual returns vary yearly. Some years may be higher or lower, but the average tends to smooth out over decades.

Can I use the calculator for different investment goals?

Yes, the Dave Ramsey investment and retirement calculator can be adapted for various goals like retirement, college funding, or major purchases. Adjust the time horizon and monthly contribution amounts based on your specific objectives.

What if I can’t invest 15% of my income right away?

Start with what you can afford and gradually increase your contributions. The key is to begin investing consistently, even if it’s a smaller amount initially. You can always increase contributions as your income grows.

Should I include employer matching in my calculations?

Yes, employer matching is essentially free money and should be included in your total investment amount. The Dave Ramsey 401k investment calculator factors in matching contributions to show your complete investment picture.

How often should I review my investment projections?

Review your calculations annually or whenever you have significant life changes like marriage, new job, or salary increase. Regular reviews help ensure you stay on track toward your financial goals.

What happens if the market performs poorly?

Market volatility is normal and expected. The Dave Ramsey investment growth calculator assumes you’ll stay invested through market ups and downs. Historical data shows that long-term investors who stay the course typically see positive results.

Can I use the calculator for international investments?

While the Dave Ramsey Investment Calculator can project growth for international investments, adjust the expected return rate based on the specific markets and funds you’re considering. International investments may have different risk and return profiles.

Conclusion

The Dave Ramsey Investment Calculator is more than just a financial tool—it’s a roadmap to financial freedom. By understanding how to use these Dave Ramsey Investment Calculators effectively, you can make informed decisions about your investment strategy and build wealth systematically over time.

Remember that successful investing requires consistency, patience, and a long-term perspective. The Dave Ramsey Investment Calculator shows the potential of compound interest, but realizing that potential requires discipline and commitment to your financial plan.

Whether you’re using the retirement investment calculator Dave Ramsey system for your golden years or the college investment calculator for your children’s education, the key is to start now and remain consistent. Time is your greatest asset in building wealth, and every month you delay investing is a month of potential growth you’re missing.

The principles behind these Dave Ramsey Investment Calculators have helped millions of Americans achieve financial independence. By following Dave Ramsey’s proven approach and using these tools effectively, you can join the ranks of those who have built substantial wealth through disciplined investing.

Take Action Today

Don’t let another day pass without taking control of your financial future. Here’s how to get started:

- Calculate your numbers – Use the Dave Ramsey investment calculator to see your potential

- Set up automatic investing – Make your contributions automatic to ensure consistency

- Choose appropriate investments – Focus on growth stock mutual funds with long track records

- Monitor and adjust – Review your progress annually and adjust as needed

- Stay educated – Continue learning about investing and personal finance

Your financial freedom doesn’t happen by accident—it’s the result of intentional planning and consistent action. Start using the Dave Ramsey Investment Calculator today and take the first step toward building the wealth you need for the future you want.

Remember: “You must gain control over your money or the lack of it will forever control you.” – Dave Ramsey

The path to financial freedom begins with a single step. Take that step today by using the Dave Ramsey Investment Calculator and committing to your long-term financial success.

Pingback: Female Delusion Calculator – Fun Way to See Your Dating Chances - ToolifyTools || Calculator Tools

Pingback: The Dave Ramsey Investment Calculator A Smart Tool for Building Your Financial Future - opblog.co.uk